I was inspired by my younger brother months ago to publish a post on my platform, sharing tips based on my experiences as a first-time tenant, to support those who are ready to embark on independent living but do not know where to begin.

Stepping out on your own (voluntarily or involuntarily) may seem rather daunting, but I promise you, it is not as bad as it may seem. With preparation and access to resources, you will be well on your way to independent living.

That said, I hope you consider and find some of the tips shared helpful as you transition into a new life phase of self-dependence.

TIPS/ADVICE

1. Rent Within Your Budget

As far as I am concerned, before exploring housing options, it demands that you budget. Review your finances: determine what you can afford. Do not spend the majority of your income solely on rent: factor in any additional expenses that you may incur; such as utilities, cable, internet, laundry, groceries, phone, transportation, insurance, etc.

A general guideline to consider is the 30% rule which suggests spending no more than about one-third of your monthly income towards rent payments.

2. Save

Income may be a barrier to some. Therefore, an alternative approach to give thought to is to simply save until you are in good financial standing to secure housing.

If you are still keen on moving out and being on your own despite your income, I would advise seeking a shared accommodation or ways to generate multiple income streams to secure and maintain housing.

3. Credit Check

Credit check is a common roadblock that most face when trying to solidify a place to rent.

Landlords will typically request a credit check to get a snapshot of one’s financial behavior prior to renting out. The information requested provides the landlord with the peace of mind knowing the tenant is responsible and will make on-going payments when expected.

If you are someone with no credit, take the time now to start building your credit; get a credit card, take out a loan, do whatever you need to do, but ensure payments are being made on time. And if your credit is not satisfactory, inquire if a co-signer is acceptable.

Whereas, if you are someone with credit, but not in good standing, work on improving it by making minimum payments towards any debts or outstanding balances that you are liable for until debts are paid in full.

4. Reference(s)

Being as you are a first-time tenant, it is unlikely you will have references (contact information or letters) from previous landlords to provide upon request. Therefore, consider obtaining letters from employers, colleagues or mentors, highlighting your qualities and why you would be a suitable tenant.

5. Questions

Below are some questions to ask the Leasing Agent or landlord about when viewing apartment/condo units.

• How much is the first month’s rent and security/damage deposit?

• Are utilities included?

• Are pets permitted? If so, inquire fee (one-time or monthly)

• What is the procedure for making a maintenance request?

• What amenities are included or nearby?

• Are there any move-in incentives being offered?

• Are rent increases given to tenants? If so, how much notice is given, and how much?

• Is there a floor plan or brochure that I can access or take?

• What is the guest policy?

• How often are pest inspection and examination completed? Good question to ask to detect if there are any pest problems in the building.

• What is the best means of communication?

• What payment methods are accepted?

6. Keep Records of Everything

Keep a record of everything!

Make a copy of your signed rental agreement. Using a video recorder with your phone, do a thorough walk-through of your unit the day you move-in; regardless if a move-in inspection was completed prior. Request rent receipts, or keep account of any transfers made payable to the landlord. And lastly, save and/or document any communication between you and the landlord.

Avoid calls, instead email, text, or handwrite (make a copy) any concerns or requests that require attention addressed to the landlord. You never know when you might need to make reference to those supporting evidence/documents in the future. Always be prepared!

7. Tenant’s Insurance

Do not cut corners when it comes to tenant’s insurance. In the same way you would get life insurance or car insurance to protect your assets and your loved ones, tenant’s insurance helps you cover the cost of replacing and repairing damages to your personal property in the event of an incident (i.e. water damage, fire, or theft).

Shop around for affordable tenant’s insurance quotes in your city to get the coverage that fits your needs.

8. Support System

Although living independently is liberating, at times it can get lonely. Surrounding yourself and/or connecting with loved ones via phone, text message, or video call can enrich your quality of life, especially where mental health is concerned.

Liven up your space by inviting guests over; host a get together, plan movie night, or a night-in with some friends. And when you are having ‘one of those days,‘ do not hesitate to reach out to a friend and/ or family member, sometimes we just need someone to listen.

9. Tenant Supports

Know your rights as a tenant! Access tenant support services in your city for advice, information, and assistance with tenancy disputes/matters.

10. Apartment Furnishing

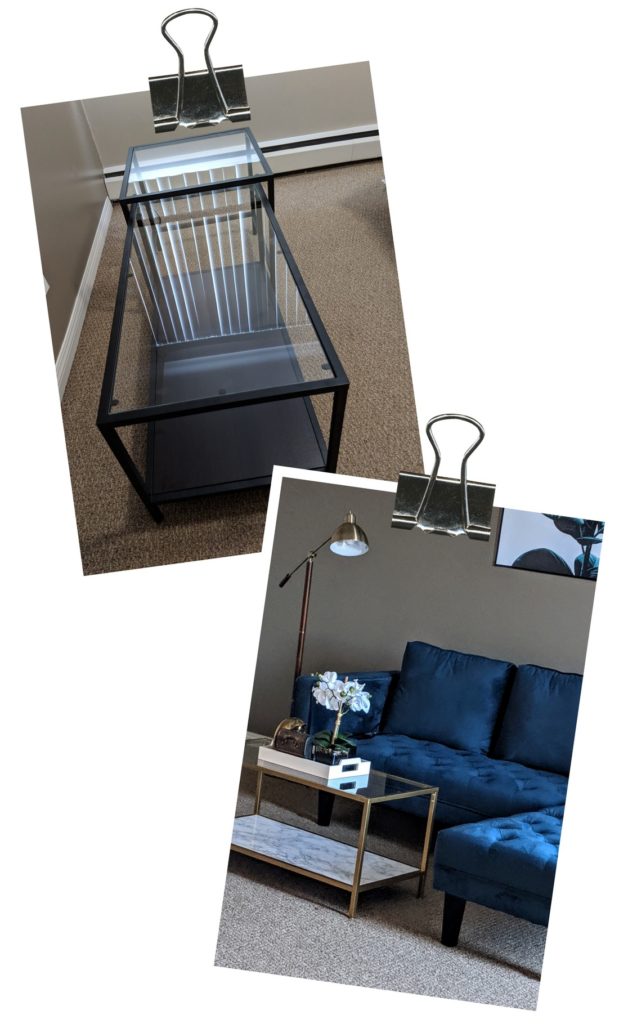

Lastly, furnishing your own apartment is like painting on what was a blank canvas, it revives your space to fit your aesthetic. However, it can be an expensive and overwhelming process.

Do not fall victim to pressure trying to get everything you need all at once. If you have the financial means to splurge on furnishing and decor, by all means go for it! But not everyone is that fortunate.

Take your time with it, seek resources in your community that provide furniture assistance, shop at thrift stores, and explore sites like Kijiji, Letgo, Facebook Marketplace for low-cost quality used or new furniture. And, if you are crafty, try out some do-it-yourself projects.

As previously stated, do not fall victim to pressure trying to keep up with the Joneses. It takes the average person a minimum of two years to get settled into their apartment — well at least it did for me, and it is still a work in progress.

In The Comments Below

Let me know what advice you would give someone who is ready to embark on independent living.

Post dedicated to my younger brother, Billy Osei. So proud of your accomplishments thus far!

– xo Abigail Osei

Leave a Reply